Alteration Row: Tinubu Insists on January 1 Commencement for New Tax Regime

President Bola Tinubu has reaffirmed that the new tax laws signed earlier this year will take effect on January 1, 2026, despite mounting opposition and unresolved allegations that the gazetted versions of the laws were altered after passage by the National Assembly.

In a statement personally signed and issued by the State House on Tuesday, the President said the implementation timeline would proceed as scheduled, describing the reforms as a historic opportunity to restructure Nigeria’s fiscal system and strengthen revenue administration across all levels of government.

President Tinubu had, on June 26, 2025, assented to four major tax reform legislations: the Nigeria Tax Act, the Nigeria Tax Administration Act, the Nigeria Revenue Service Act, and the Joint Revenue Board Act. While aspects of the reforms took effect immediately, others were slated for commencement on January 1, 2026.

According to the President, the reforms are not intended to impose additional tax burdens on Nigerians but to harmonise existing frameworks, improve efficiency, and rebuild trust between citizens and the state. He acknowledged public concerns over alleged alterations to the laws but maintained that no substantial issue had been established to justify halting implementation. He also pledged continued engagement with the National Assembly to address any verified anomalies.

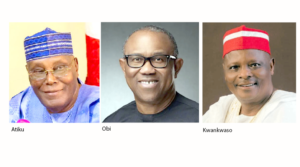

The President’s position has, however, drawn sharp criticism from opposition figures and political parties. Former Vice President Atiku Abubakar described the insistence on a January 1 rollout as hasty and irresponsible, arguing that the controversy surrounding the alleged alterations must first be conclusively resolved. He questioned why the Federal Government was proceeding without making available certified copies of the laws for public scrutiny, warning that any discrepancy between what was passed and what was gazetted could have serious legal consequences.

Similarly, the Peoples Democratic Party (PDP) accused the administration of prioritising revenue generation over the welfare of Nigerians. The party called for the suspension of the commencement date pending a comprehensive investigation, insisting that public confidence in tax laws depends on clarity, transparency, and legislative integrity.

The controversy gained traction on December 17, 2025, when a member of the House of Representatives, Abdulsamad Dasuki, alleged that provisions contained in the gazetted tax laws differed materially from those debated and approved by lawmakers. The claims prompted concerns about possible constitutional and procedural breaches, particularly regarding provisions said to grant expansive coercive and fiscal powers.

In response, the leadership of the National Assembly directed the re-gazetting of the Acts and the issuance of Certified True Copies reflecting versions duly passed by both chambers. An ad hoc committee was also constituted to investigate the sequence of events surrounding the passage, assent, and gazetting of the laws.

Despite these steps, calls for a suspension of the January 1 commencement date have continued. Labour unions, professional bodies, and several political actors have urged caution, arguing that even the perception of irregularity is sufficient to undermine public trust in reforms with far-reaching economic implications.

The Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, has nevertheless assured that implementation will proceed as planned, noting that the reforms are designed to reduce the tax burden on low-income earners and exempt the vast majority of small businesses from key taxes.

As the debate continues, the unfolding dispute highlights the tension between policy urgency and procedural legitimacy, with January 1 now looming as both a fiscal milestone and a test of institutional credibility.